PEPE Gets Bullish Filter 30%—Under If This Happens!

The crypto market is picking up steam again, and PEPE is poised to take the ride. But there’s a catch. It must remain above an important support line. If it does? This could lead us to a huge 30% pump in the near term.

PEPE Price Action: Strengthening or Weakening?

For all who dwell in the crypto-verse, March 2nd provided some respite. PEPE, the third-largest memecoin, is buzzing back with life after a bloodied fall. It has been hovering around the $0.0000077 level, up 1.5% for the last 24 hours. It’s a small gain, sure, but the real action may yet to come.

However, trading volume? That’s a different story. Selling, down 38%, meaning traders are somewhat skittish. Fear’s still in the air and fewer hands are shuffling PEPE around. But here is a twist — even as a slowdown is underway, big money is on the move.

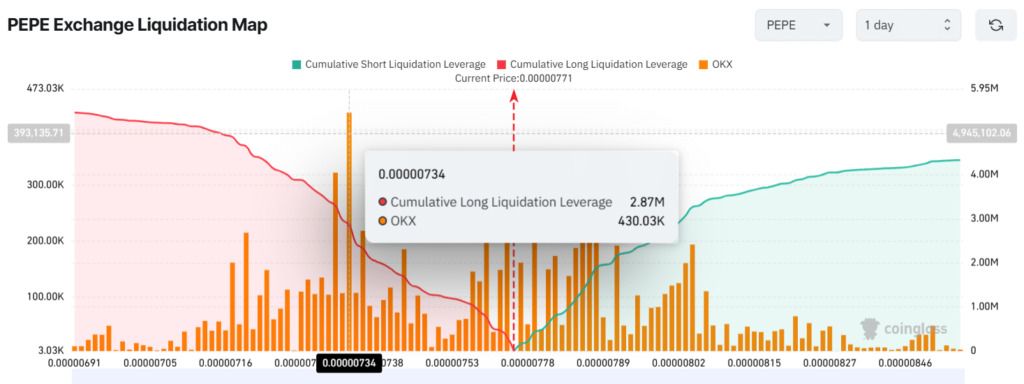

The Level to Keep an Eye On – $0.00000765

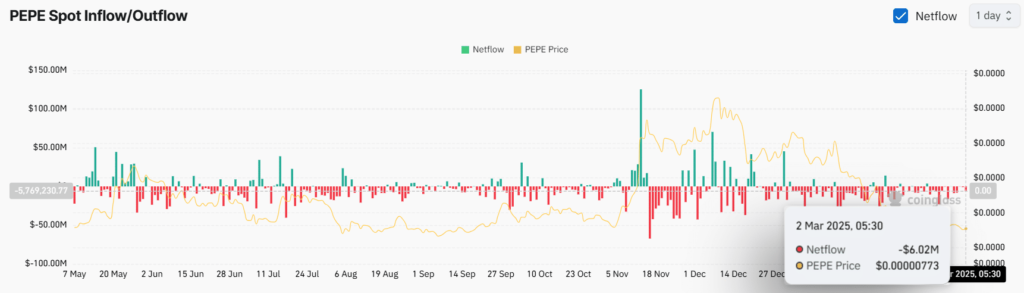

Source: CoinGlass

This price point is not some arbitrary figure. It has proven a key pivot level in the past. When PEPE has historically bounced off it, the price surged. And guess what? It is sitting right on top of it once more.

If it can hold above $0.00000765, analysts call for a 30% rally to $0.0000105. Maybe. But the technical indicators are flashing green.

Things Are Coming Together — As Are Bets

Another major metric, the Average Directional Index (ADX), is currently at 35 and rising. It’s no surprise PEPE has built some serious momentum.

In the meantime, traders are making big bets — and some are overexposed.

Traders long at $0.00000734 have $2.9 million in open positions.

At $0.00000788, the short traders continue to hold their ground with $1.9 million in short positions.

As leverage builds, a breakout in either direction may follow. But the smart money? So far, it looks bullish leaning.

Below Image Source: TradingView

$6.5 Million Outflow — Strong Buy Signal?

Something interesting regarding the $6.5 million worth of PEPE exiting exchanges was shown in on-chain data. That is typically a bullish signal. Why? Because when traders take their holdings off exchanges, they’re probably hiding them rather than selling. This means less supply on the market = More potential for a price spike.

And OI is up 5%, again suggesting more traders are getting on the rollercoaster. Activity is picking up.

Is a PEPE Pump Inevitable?

Everything is lining up: strong support, bullish indicators, and big money flooding in, PEPE could be set for a big move. But it all comes down to one thing: staying above $0.00000765.

If it does? Strap in. A 30% pump may soon be on the way. 🚀